Complete Guide to Input Tax Credit under GST

As a business owner and taxpayer, you need to understand Input Tax Credit to be able to maximise your tax benefits and reduce unnecessary tax liabilities. Input Tax Credit allows businesses to claim a credit for taxes they have paid on the purchase of goods and services that they use for business purposes.

However, there are certain regulations and stipulations surrounding ITC, which can be complex and confusing. Claiming ITC requires meticulous record keeping and adherence to current GST laws. It is a good idea to use a powerful GST Accounting Software to ensure that you remain on track with your GST compliance.

In this article, we will provide you with a thorough understanding of Input Tax Credit, explaining what Input Tax Credit is, how to claim it, conditions to claim it and much more. By the end of this guide, you should be able to take full advantage of this important tax benefit.

BOOK A FREE DEMO

What is the Input Tax Credit?

Input Tax Credit or ‘ITC’ is a tax benefit that allows businesses to subtract the tax they have already paid on inputs used in the production of goods and services from the total tax they have to pay on the sale of goods and services. This offset of taxes paid on purchases against taxes to be paid on sales reduces the overall tax liability of a business.

Input Tax Credit Explained with an Example

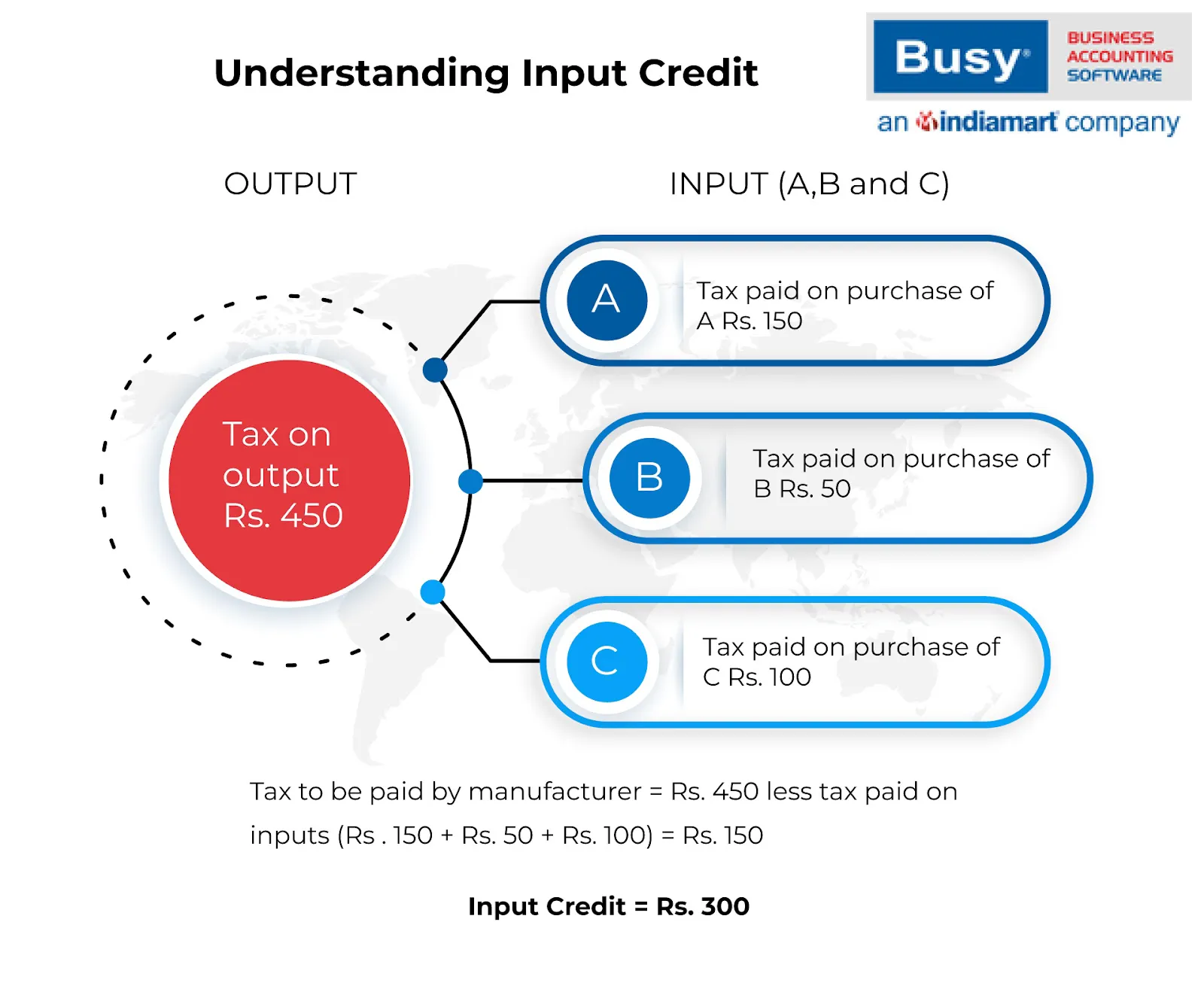

Let’s look at an example to help us better understand Input Tax Credit:

‘A’ purchased goods and services worth Rs 30,000, on which the GST rate is 18%, i.e., Rs 5,400. Thus, the total amount paid by ‘A’ would be Rs. 35,400, out of which Rs. 5,400 will be paid as GST. Later, ‘A’ sells the product for Rs 40,000, and again the GST rate is 18%, which comes to Rs 7,200. This Rs. 7,200 is due to the Government (as applicable under the different types of GST).

However, since the Government has already received Rs. 5,400 as GST from ‘A’, he is now liable to pay only the difference amount, which is Rs. ‘1,800’. The Rs 5,400 that A has already paid while purchasing the goods and services can be claimed by him as Input Tax Credit. A visual representation of this is given below:

| Description | Amount in Rs |

|---|---|

| GST payable (outward) | 7,200 |

| GST paid on the purchase | 5,400 |

| Net GST payable | 1,800 |

Rules to Claim Input Tax Credit in India

To claim Input Tax Credit, businesses need to follow the rules mentioned below:

- They need to have a valid invoice, bill or document issued by a GST registered seller.

- They must have received the goods or services they paid for.

- The seller must have paid the taxes on those purchases to the government.

- The seller must have also filed their GST returns.

- Businesses can only claim ITC if their seller is GST compliant and has paid the taxes collected from them.

- The details of invoices and bills must be provided in Form GSTR-1 / Invoice Furnishing Facility and communicated to the registered person in Form GSTR-2B.

- Businesses must pay their suppliers within 180 days to claim ITC.

Input Tax Credit must only be claimed for goods and services that are used for business purpose and not personal use. If you purchase goods for both business and personal use, you need to know the ITC rules for Common Credit.

Furthermore, a business operating under the composition scheme is ineligible for input tax credit. ITC cannot be claimed for exempt goods or goods bought for personal use.

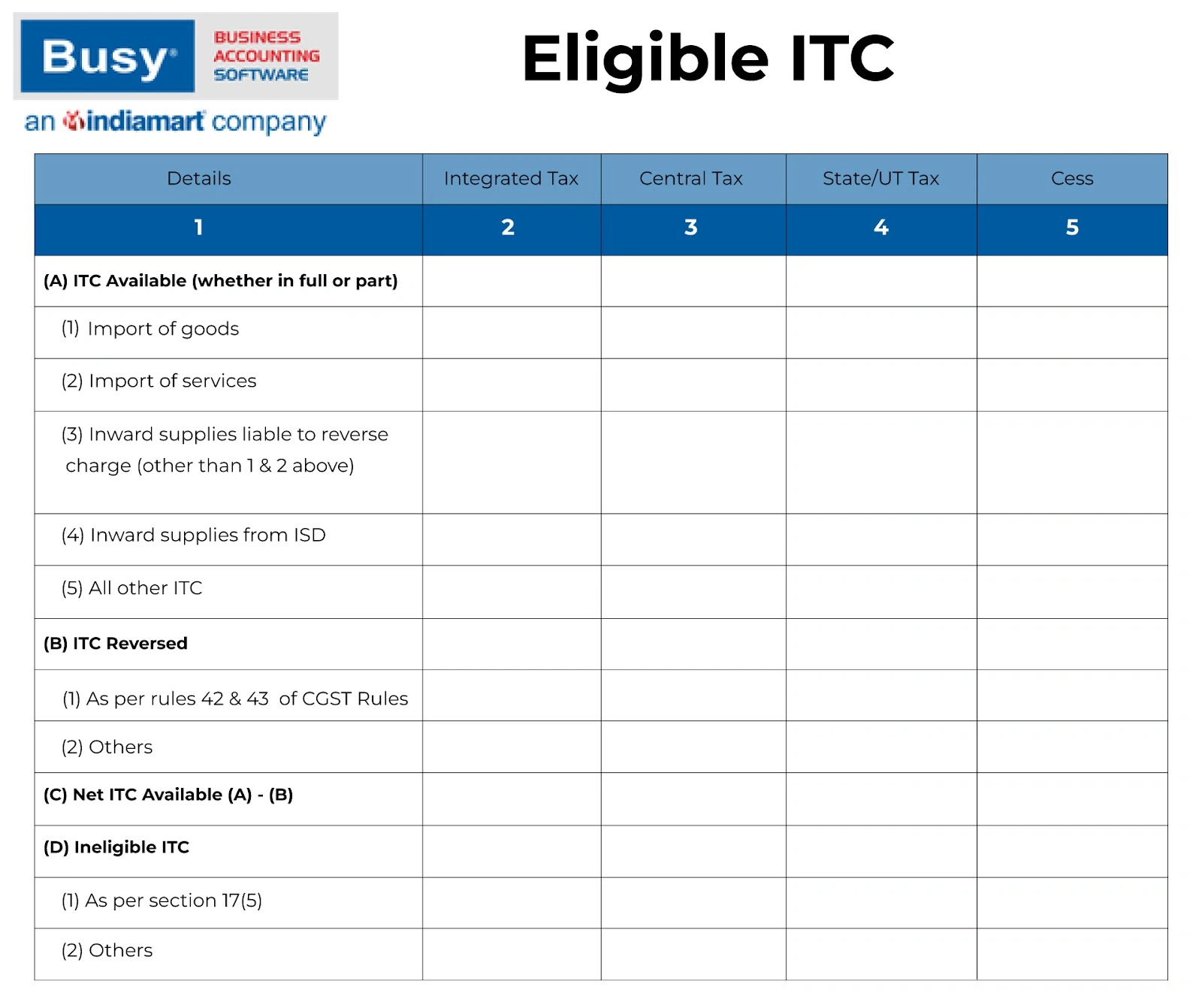

To claim ITC, all regular taxpayers must report their input tax credit (ITC) in their monthly GST returns using Form GSTR-3B.

Table 4 of the form (shown below) requires a summary of eligible ITC, ineligible ITC, and ITC reversed during the tax period.

Taxpayers can claim ITC on a provisional basis in the GSTR-3B, up to 20% of the eligible ITC reported by suppliers in the GSTR-2A return.

Taxpayers should double-check the GSTR-2A figure before filing GSTR-3B. Matching the purchase register or expense ledger with the GSTR-2A is important, since taxpayers can claim only up to 20% of the eligible ITC reported by suppliers in GSTR-2A.

Documents Required to Claim ITC in India

To claim ITC in India, you need to provide the following documents:

- A valid tax invoice issued by a registered GST supplier

- A Bill of supply issued by the supplier in cases where the total amount is less than ₹200 or if Reverse Charge is applicable.

- A debit note issued by the supplier in cases where the taxable value of the invoice is less than the actual tax paid on the supply of the goods and services

- A valid invoice or credit note issued by an Input Service Distributor (ISD)

- Bill of entry from the Customs department

Who is Not Eligible to Claim Input Tax Credit?

Cases where the taxpayer will not be eligible to claim ITC are mentioned below:

- ITC cannot be claimed for motor vehicles used to transport people and which have a seating capacity of 13 or less including the driver

- ITC cannot be claimed for vessels and aircrafts

- ITC is not available for the supply of food and beverages, outdoor catering, cosmetic or plastic surgery, or health services.

- ITC cannot be claimed for general insurance services, servicing, repair, and maintenance.

- ITC does not apply to sell membership in a club or health fitness centre.

- Travel, perks provided to employees when they are on vacation, such as leaves, or home travel concessions, are not eligible for ITC.

- ITC shall not be offered for any services under a labour contract. ITC cannot be used to develop an immovable property unless the input service is used for subsequent work contract services.

- A non-resident taxable person cannot obtain ITC for goods or services they receive. ITC is only accessible on products it imports.

- ITC will not apply to products or services utilised only for non-business objectives.

- Input tax credit cannot be claimed for misplaced, stolen, destroyed, written off, or given away as gifts or free samples.

- Independent restaurants will only be required to pay 5% GST, but they will not be eligible for any input tax credits.

There are many exceptions to the scenarios mentioned above, which we cover in our article on conditions when ITC cannot be claimed.

What is the Time Limit to Claim Input Tax Credit in India?

The time limit to claim ITC for any particular invoice or debit note is dictated by the date on which the invoice or debit note is issued. You can claim ITC by the earlier of two dates:

- 30th November of the subsequent financial year

- Date of filing annual returns for the current financial year in GSTR-9. Last date is 31st December of the next financial year.

For instance, let’s assume person ‘A’ is in possession of an invoice dated 5th January 2023. Hence, this invoice is dated within FY 22-23. According to the dates mentioned above, the earlier date is 30th November 2023, so ‘A’ must claim any eligible ITC by that date. However, if ‘A’ files his GSTR-9 on 20th November 2023, then he must claim ITC by that date itself, as it is the earlier of the two dates.

Reversal of Input Tax Credit

Input Tax Credit will be reversed under the following circumstances:

- If ITC is claimed against any bills that are not paid within 180 days of issuing

- If the exporter issues the credit note to an Input Service Distributor

- If an input is used partially for excluded supplies or personal use. Products and services used for personal use will have a proportionate reversal, whereas exempted commodities are not eligible for input tax credit under GST.

- Capital goods partially used for business and partially for exempted supplies or personal use.

- If the total ITC on inputs that are exempt or utilised for non-business purposes surpasses ITC that was reversed throughout the year, once the annual return is submitted, the difference is charged to the output tax liability along with any applicable interest.

You can read our detailed article on the Reversal of Input Tax Credit.

Reconciliation of Input Tax Credit

Reconciliation compares two data sets to identify disparities. Reconciliation also aids in keeping track of human errors.

Essentially, the Input Tax Credit claimed by a business must match the input tax credit declared by suppliers of that business. Any difference in these figures must be corrected or ‘reconciled.’

Whenever a supplier files GSTR-1, where he discloses his monthly sales, the data pertinent to a particular recipient is recorded automatically in that recipient’s GSTR-2A and GSTR-2B. When the recipient claims ITC in Form GSTR-3B (monthly), that figure must match the ITC calculated automatically based on GSTR-2B.

Reconciling data entered in Form GSTR-3B with auto-generated data in GSTR-2B is the most popular technique for reconciling ITC. It is crucial to avoid unwanted scrutiny and notices from the tax authorities.

Input Tax Credit in Special Cases

ITC for Capital Goods

Any input tax credit applicable to capital items may be used simultaneously. If a person has already claimed ITC depreciation for their GST component, they are not eligible to claim ITC for capital items. Either income tax depreciation or ITC claims are allowed.

ITC on Job Work

One may make an ITC claim on items or capital goods given to an employee for that work. Even if the goods are provided to the employee without being delivered to their place of business, input is still permitted. It will be presumed that the inputs were supplied to the employee on the day they were sent if the employer does not receive the items back from the employee within a year of sending them.

ITC Provided by Input Service Distributor

The branch office, corporate headquarters, or the registered office of the GST-registered person can all be considered input service distributors.

Additionally, ISD collects ITC from all of its purchases and distributes it to all its receivers under different headings such as IGST, CGST, SGST/UTGST, or cess.

ITC on Transfer of Business

Business transfers, mergers, and amalgamations are eligible for ITC claims. The transferor will have ITC available at the business transfer date, which it can transfer to the beneficiary.

Advantages of GST Input Tax Credit

There were many kinds of indirect taxes in the old tax system, and the input tax credit of one tax could not be recovered against the input tax credit from another. For instance, retailers that previously paid service tax on the rent for their stores were unable to combine the input tax credit for service tax with the VAT they had levied on the sale of goods. With the implementation of the GST, these problems have been resolved because there will only be one indirect tax imposed, and a credit will flow without interruption.

Conclusion

The feature of the Input Tax Credit serves as the foundation of GST and is one of the main justifications for implementing GST. ITC thus ensures a seamless flow in the tax system and helps a firm’s growth.

Other related articles to ITC

- Who can claim ITC in India?

- Reversal of Input tax credit

- Special cases under which ITC is not applicable

- What expenses can be claimed as ITC?

- Input tax credit on Capital goods

- Claiming ITC on the transfer of business

- Availing ITC as per section 16 (2) (aa)

- Reconciliation under GST

- Input tax credit on common credit

- Input service distributor under GST

- Input tax credit on Job work

- How to claim Maximum ITC: Time limits and tips

- Everything you need to know about GST Rule 86B: Limitation on ITC utilisation in the electronic credit ledger

- GST Rates for ProductsGST Rates: GST for marriage hall GST for car GST on online gaming GST for vegetables cold drinks GST rate GST for restaurant GST on electricity GST for spices GST for bakery products GST rate for transportation GST for computer parts GST on camera GST on vehicle insurance gst on postpaid mobile bill GST for silk sarees GST on plastic items GST on consultancy services GST on movie tickets GST for electrical items GST on insurance premium

Frequently Asked Questions

- Who is eligible to claim Input Tax Credit under GST?Businesses registered under GST and involved in the supply of taxable goods or services are eligible to claim Input Tax Credit (ITC), provided they have valid invoices and meet other prescribed conditions. However, entities engaged in exempt supplies or non-taxable activities are not eligible to claim ITC.

- What are the conditions for claiming Input Tax Credit?To claim ITC, the recipient must be in possession of a valid tax invoice, the goods/services must be used for business purposes, and the tax must be paid to the government. The recipient should also ensure that the supplier has filed their GST returns and remitted the tax.

- What documents are required to claim Input Tax Credit?To claim ITC, businesses must have valid tax invoices, debit notes, or credit notes issued by the supplier. Additionally, they must ensure that the supplier has filed GST returns and that the tax has been paid to the government. Proper records must also be maintained.

- Can Input Tax Credit be claimed on goods used for personal purposes?No, Input Tax Credit cannot be claimed on goods or services used for personal purposes. ITC is only allowed for goods and services used in the course of business. Personal consumption of goods is not eligible for input tax recovery under GST.

- Is ITC available on capital goods under GST?Yes, ITC is available on capital goods under GST, provided the capital goods are used for business purposes. The credit can be claimed in full or in parts, depending on the useful life of the asset. Capital goods must also be used to make taxable supplies.

- How is Input Tax Credit calculated under GST?ITC is calculated based on the input tax paid on eligible goods and services used for business purposes. The total ITC is reduced by any ineligible credits and prorated for capital goods over their useful life. Adjustments are made if goods are used for exempt supplies.

- What is the time limit for claiming Input Tax Credit?The time limit for claiming ITC is the earlier of the following: within the due date of filing GST returns for the month of September of the following year or the actual date of filing the annual return for that financial year.

- Can ITC be claimed on goods and services used for exempt supplies?No, Input Tax Credit cannot be claimed on goods or services used for making exempt supplies under GST. Businesses must keep track of input tax used for exempt supplies and exclude it from the ITC claim.